To make meaningful progress, reformers must challenge industry conventions, which means examining the assumptions that govern both VC investing and their own thinking. firm survival, and show that among exiting VC-backed firms this is more likely due to a merger/acquisition.

Venture capital fund model how to#

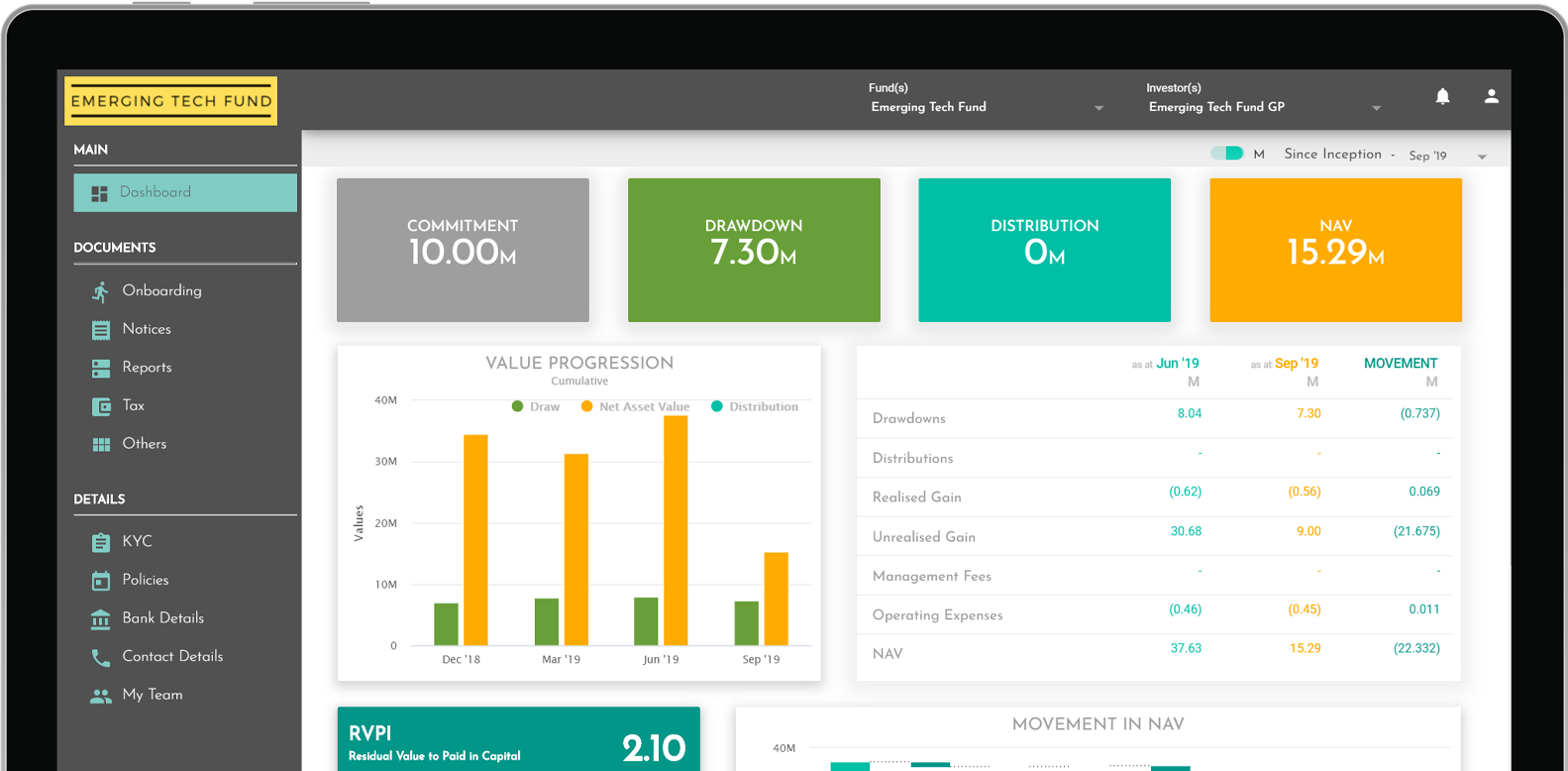

But how to go about it? Prevailing approaches such as diversity pledges, investor-matching tools, and investor-training programs tend to be overly deferential to incumbent thinking, reflecting the same entrenched biases and assumptions they seek to change. Venture capital funds raise a large part of their funding from institutional investors and they usually invest large amounts into firms with the potential. The data are clear-diversification efforts have the potential to increase financial returns and diversify entrepreneurship. The real problem, they say, is a lack of qualified entrepreneurs from underrepresented groups. Meanwhile, VC insiders continue to insist incorrectly that the industry, while far from perfect, does a good job of identifying and funding the most deserving founders. In recent years, this frustration has boiled over into a full-fledged movement, with a growing chorus of voices arguing that venture capitalists are destroying value by overlooking founders from swaths of the population including women, people of color and those from other disfavored regional or class backgrounds.ĭespite study after study demonstrating that this pattern of bias has led to profoundly negative economic consequences-and that founders and investors who come from outside the VC bubble reliably and substantially outperform insiders-no amount of activism so far has been able to amend VC’s dismal diversity track record. and European investments, including stakes in publicly-traded companies, Axios has learned. Sequoia Capital, one of the worlds oldest and most successful venture capital firms, is forming a single fund to hold all of its U.S. Employ sound reporting practices that ensure transparency and effective communication with Limited Partners.

Fund Managers should: Maintain appropriate financial and other controls. The social and racial homogeneity of the venture capital industry has long been a source of frustration for entrepreneurs and investors alike. Scoop: Sequoia Capital just blew up the VC fund model. Operating Principles Principles for Operating a Venture Capital Fund NVCA recognizes the significant responsibilities venture capital firms have to their Limited Partners.

0 kommentar(er)

0 kommentar(er)